The International Conference on Computational Social Science, abbreviated IC²S² 2019, will be held at the University of Amsterdam from July 17 to 20, 2019. The CORPNET computational social science research group is enthusiastic and excited about bringing this important conference to Amsterdam.

For four days, from July 17 to 20, the University of Amsterdam will be the epicenter of computational social science, hosting the 2019 edition of International Conference on Computational Social Science (IC2S2).

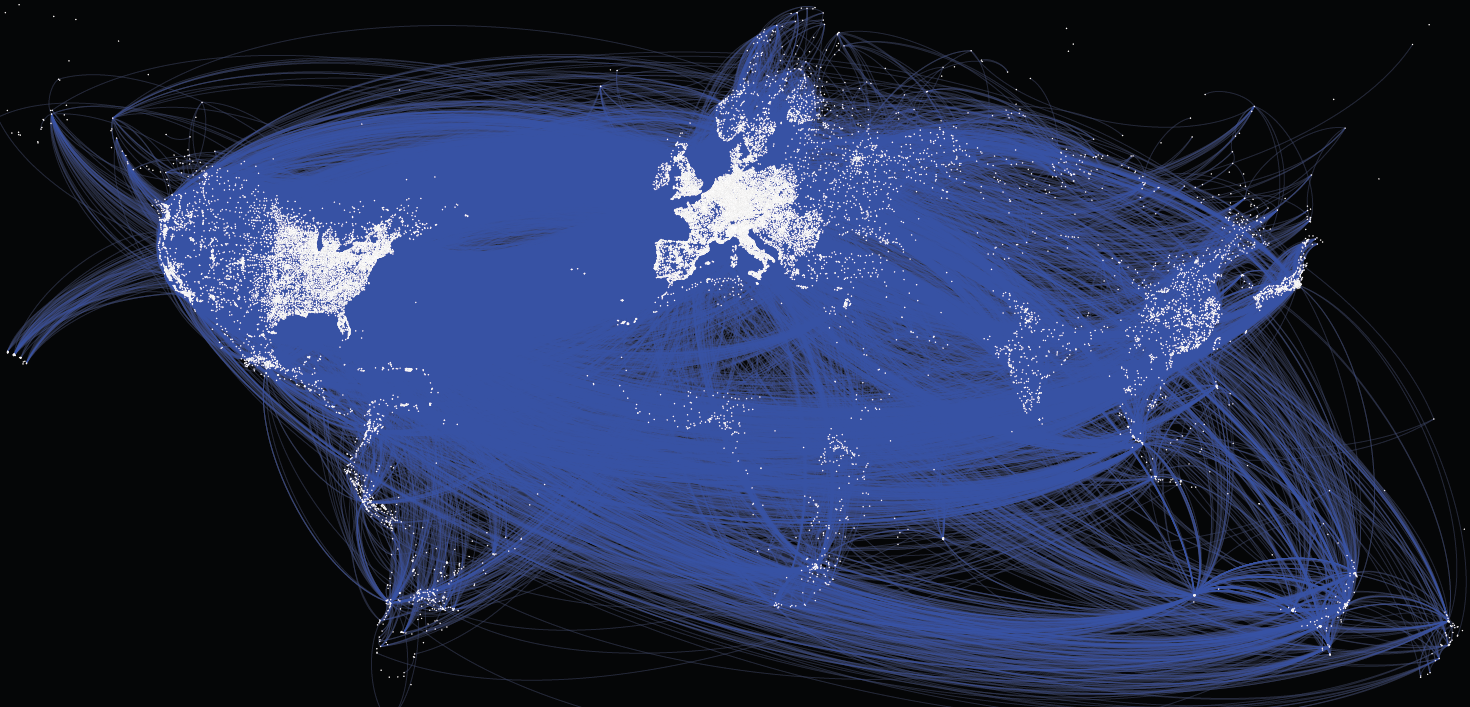

The 5th edition of IC2S2 aims to bring together scientists from different disciplines and research areas to meet and discuss computational problems in the study of social systems and dynamics. The conference draws over 350 researchers and practitioners from over 20 countries and an array of disciplines including amongst others sociology, psychology, communication sciences, computer science, physics, mathematics, the life sciences and economics.

Leading scientists and experts from all over the world will gather and exchange newest research findings during the conference. A data-thon will allow researchers to demonstrate their computational analysis skills while tackling real-world problems, while skills workshops will help attendees develop their computational skillsets.

Stay up to date

More information about the conference is on the website.

Follow IC2S2 Twitter account

Check out this Video IC2S2 comes to Amsterdam