Corporate Network Governance: Power, Ownership and Control in Contemporary Global Capitalism

Who is in charge of international business?

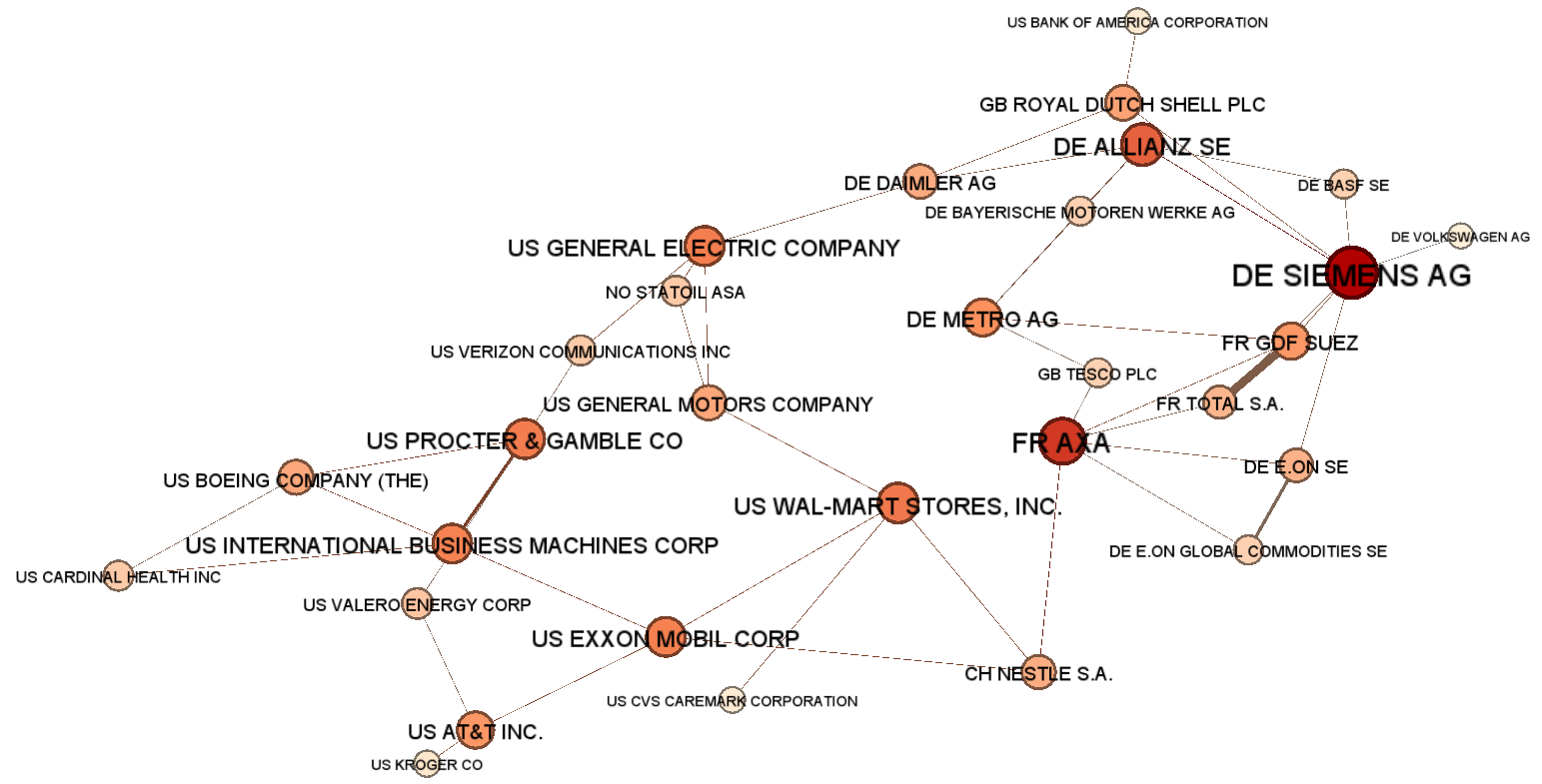

Business is strongly intertwined worldwide. Corporations share managers and directors and they even own each other’s firms. In CORPNET a team of social and computer scientists map this network of tens of millions of companies in the world. By doing so we can find out and analyse how international elites got their economical power and influence, and how they keep it.

CORPNET Project summary

The character of global business networks has long fascinated but continues to divide scholars of global markets and governance. A well-established perspective looks at the changes in global networks and sees an emerging cohesive transnational capitalist class. However, a rival line of inquiry sees the rise of competing corporate elites. Scholars also disagree on the origins of emergent patterns of corporate networks. Do they reflect institutional preferences of corporate and political elites? Or are they unintended by-products of corporate conduct? Third, there are fundamental differences of opinion on how patterns of global corporate ownership relate to actual power in the governance of such networks.

Past research has been unable to adjudicate these debates in part due to insufficient data clarifying the full breadth of corporate interactions globally, and insufficient analytical tools for analysing that breadth. This project seeks to do what has so far eluded existing scholarship: to fully explore the global network of corporate ownership and control as a complex system. Network structures may appear to be the result of a grand design at macro level, but are the outcome of the sum of the actions of a large set of interdependent actors. Using cutting-edge network science methods, the project explores for the first time the largest database on ownership and control covering over 100 million firms. Exploiting the longitudinal richness of the new data in combination with state-of-the-art methods and techniques makes it possible to model and empirically test generating mechanisms that drive network formation.

By doing so the project bridges the hitherto disjoint fields of social network studies in socio-economics and political science on the one hand, and the growing body of literature on network science in physics, computer science and complexity studies on the other.

Subprojects

The overarching project aims to develop a theoretical and empirical understanding of complex global networks of corporate ownership and control. It is divided into five concrete and practical subprojects with a multi-disciplinary team of five junior and senior (social) scientists.

1. Causes and Consequences

Causes and consequences studies the causes and consequences of the global network of corporate ownership and control and serves as the integrative project. This project sets the basis for the analytical and theoretical frameworks of the subprojects.

The ‘Causes and consequences’ project integrates the other projects. First, the theoretical perspective on corporate global ownership will be developed to serve as a cornerstone for ‘Re-concentration’ and ‘Global corporate regime’. Second, the project delineates the theoretical outline for the actor-based model, tested in ‘Driving-forces’. Third, the project is closely involved in the data refining and enhancement stage in the first year of ‘Network structures’.

2. Driving-forces

Driving-Firces studies the generating mechanisms that drive the formation of corporate government networks. The main object of study is the network of interlocking directorates.

The ‘Driving-forces’ project builds a conceptual framework that tries to explain the formation and (dis)continuation of corporate board overlap through the strategies of the actors involved. After all, board interlocks are the result of firms seeking directors and persons accepting positions on corporate boards. The conceptual framework considers how ownership ties interact with interlocking directorates. This project will use the longitudinal data ‘Network structures’ provides to test whether and how in different parts of the global network actors deploy different network strategies.

3. Global Corporate Regime

Global Corporate Regime studies three critical features of the global network of ownership and control. These features are first role of the state, second the role of financial institutions in the network and third the extent to which there is a global corporate regime.

The ‘Global corporate regime’ project focuses on the three critical features of the global network of ownership and control. First, the role of the state as owner in the global network of ownership and control. The project deepens our understanding of the position of states in the global corporate governance networks and explores the geopolitical consequences. Second, the role of financial institutions in the network. Since the end of the twentieth century, banks and financial institutions have shed the durable relationships of ownership and control with big business. Third, it explores if the extent to which there is a distinct set of practices and relations that determine how corporations are ruled.

4. Network Structures

Network Structures focuses on the properties of the global network of ownership and control as a complex system. It applies complex social network analysis through the use of key concepts and methods in social network analysis, theoretical physics and modern mathematics (particularly graph theory and fractal geometry).

The ‘Network structures’ project is the first key step for the work of the entire group, it starts by enhancing and cleaning the data sourced from ORBIS. ORBIS contains comprehensive information on companies worldwide both listed and unlisted. The project creates a longitudinal dataset of the global corporate governance network, covering over 100 million firms, their directors, owners and shareholders. Understanding the properties and structure of the global network allows one to look for distinct subsets, communities and local properties.

The ‘Driving forces’ and ‘Re-concentration’ projects will use the outcomes of the community detection.

5. Re-concentration

Re-concentration investigates corporate ownership relations across the globe and gives the empirical underpinning to the notion that we are now witnessing a re-concentration of global corporate ownership in the hands of a new group of financial intermediaries

The core focus of the ‘Re-concentration’ project is on ownership, it complements the interlocking directorates’ perspective of ‘Driving-forces’. Theoretically, the project engages in the discussion on the relationship between corporate ownership and corporate power. In a world of fragmented ownership, corporate directors and managers are the more powerful actors. In a world of concentrated ownership however, directors lose power and influence. This project seeks to answer the question to what extent the new concentrated owners and the corporate elite of directors are separable entities.